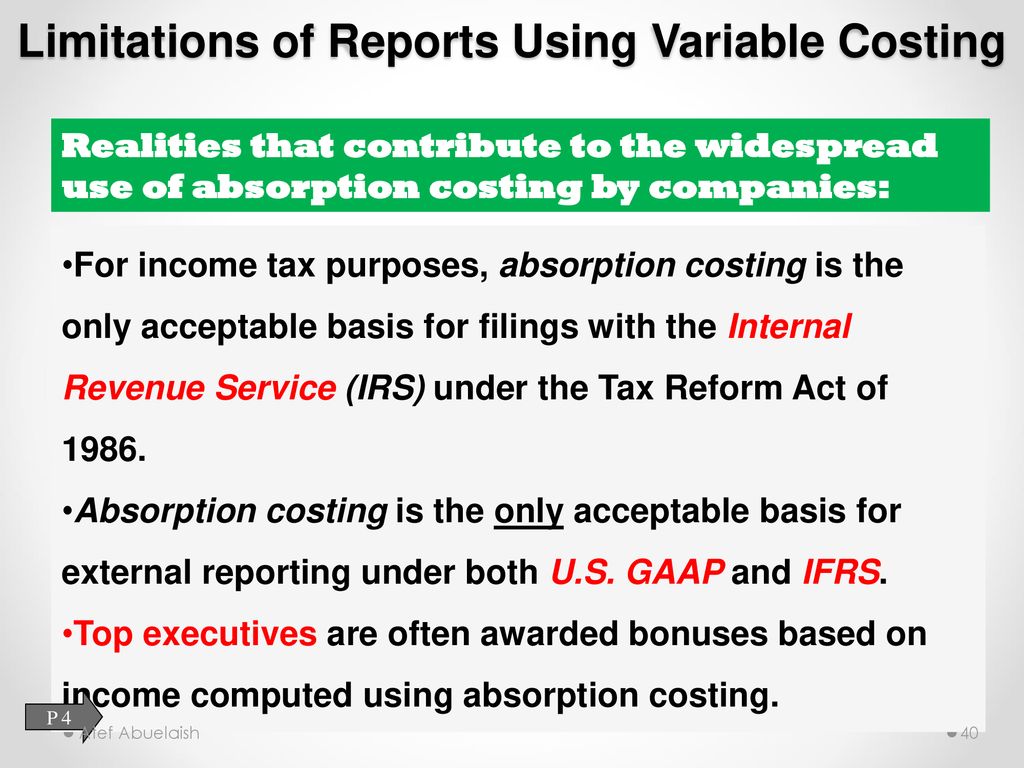

The frameworks do not favor the use of variable costing, because it does a poor job of matching revenues with all related expenses. Under variable costing, overhead costs are charged to expense at once, rather than when the related sales occur (which may be in a later period). Consequently, this methodology is only used for internal reporting purposes.

Key Differences Between Costing Methods

Process costing is a cost accounting method used to allocate costs to products that are mass-produced in a continuous flow. The main principle of process costing is to accumulate costs for each process or department over a specific period and then distribute these costs evenly across all units produced during that period. Managers as agents of shareholders have a duty to protect and generally increase the value of the shareholders’ wealth. One avenue through which shareholders can monitor the progress of the management is through financial statements. Since the variable costing approach doesn’t present accurate income figures, it is not allowed in the preparation of financial statements for external users.

What is Standard Costing?

The difference is that the absorption cost method includes fixed overhead as part of the cost of goods sold, while the variable cost method includes it as an administrative cost, as shown in Figure 6.12. The rationale for absorption costing is that it causes a product to be measured and reported at its complete cost. Because costs like fixed manufacturing overhead are difficult to identify with a particular unit of output does not mean that they were not a cost of that output.

Matching Costs

- Fixed overhead is not considered a product cost under variable costing.

- Fixed manufacturing costs are regarded as period expenses along with SG&A costs.

- You can see exactly how changes in sales affect your bottom line.

- Standard costing, through its systematic approach to setting cost expectations and analyzing variances, provides valuable insights for managing production costs and improving operational performance.

Generally Accepted Accounting Principles (GAAP) are a set of rules and standards used in the United States to ensure consistency, reliability, and transparency in financial reporting. Developed by the Financial Accounting Standards Board (FASB), GAAP encompasses a wide range of accounting principles and procedures that companies must follow when preparing their financial statements. These standards are crucial for providing stakeholders, including investors, creditors, and regulators, with accurate and comparable financial information.

Income Statement Impact

They further argue that costs should be categorized by function rather than by behavior, and these costs must be included as a product cost regardless of whether the cost is fixed or variable. what’s the difference between amortization and depreciation in accounting A typical illustration of decision making based on variable costing data looks simple enough. Considerable business savvy is necessary, and there are several traps that must be avoided.

Month 3: Number of Units Produced Is Less Than Number of Units Sold

As a result, $15,000 more is assigned to inventory under absorption costing. This logically coincides with the degree to which income is higher! Another way to view the impact of the inventory build-up is to examine the following “cups.” The top set of cups initially contains the costs incurred in the manufacturing process. With absorption costing, those cups must be emptied into either cost of goods sold or ending inventory. Activity-Based Costing (ABC) is a costing method that assigns costs to products and services based on the activities that drive those costs. The principle behind ABC is that products consume activities, and activities consume resources.

Because absorption costing defers costs, the ending inventory figure differs from that calculated using the variable costing method. To further examine the reason income is higher, remember that $450,000 was attributed to total production under absorption costing. Of this amount, 10% ($45,000) is now diverted into inventory. Under variable costing, total product costs were $300,000 and 10% ($30,000) of that amount would be assigned to inventory.

Professional sports clubs will occasionally offer deep discount tickets for unpopular games. Obviously, the variable cost of allowing someone to watch the game is nominal. Likely, variable costing information is taken into account in making the decisions relating to these types of examples.